Think of a balance sheet as a snapshot of the company's finances, showing what it owns and owes at one point in time. Every business has to prepare three kinds of financial statements, and one of these is a balance sheet.

A balance sheet is the financial document that outlines three of the most critical items: Assets (what, if anything, the business owns), Liabilities (what, if anything, it owes to other people), and Share Holders Equity (what, if anything, it owes its owners). Sometimes you may come across it labeled as ‘Statement of Financial Position'.

Through this blog, we’ll explain what the makeup of a balance sheet is, how to interpret it, and its significance to business people, investors, as well as regulators. We’ll walk through the anatomy of a balance sheet using the example of Apple Inc. to demonstrate to you the practical application of this information.

What is a Balance Sheet?

A balance sheet is a type of finance statement showing what a business owns and what it owes at any one time. The balance sheet has a simple formula: what the business has (assets) must equal what it owes to others (liabilities), plus what the owners are worth (equity).

Purpose of a balance sheet:

Shows the financial health of a business on a specific date

Helps owners and investors understand if the company can pay its bills

Required for loan applications, investor pitches, and regulatory filings

Provides a baseline to track financial growth over time

How it differs from other financial statements:

The balance sheet differs greatly from an income statement and a cash flow statement. While an income statement represents profitability over an interval (such as a year or a quarter), a balance sheet represents an instant. The cash flow statement represents actual funds flowing, whereas a balance sheet represents funds as well as non-cash items such as inventory and property.

Remember this analogy: the income statement is a video of your financial performance, while the balance sheet is the picture taken at the end of the video.

Related Reading: What is a Financial Statement?

How Does a Balance Sheet Work? (The Accounting Equation)

Assets = Liabilities + Shareholders' Equity

This is the foundation of double-entry accounting, and both sides must always balance. If they don't match, there's an error in your records.

Why it must balance:

Every dollar of assets is funded either by borrowing (liabilities) or by owner investment and retained profits (equity)

When you buy equipment with a loan, both assets and liabilities increase by the same amount

When you pay off debt with cash, both assets and liabilities decrease equally

Simple Analogy: If you acquire a $300,000 house by paying $240,000 as a mortgage and $60,000 as a down payment, then you can see that value of the house (asset) is equivalent to the mortgage (liability) + down payment (equity) because it balances: $300,000 = $240,000 + $60,000.

Main Sections of a Balance Sheet

A balance sheet has three main sections. Here's what each includes:

Section | Type | What It Includes | Examples |

|---|---|---|---|

Asset | Current Assets | Resources that will convert to cash within one year | Cash, accounts receivable, inventory, prepaid expenses |

Non-Current Assets | Long-term resources held for more than one year | Property, equipment, vehicles, patents, trademarks, long-term investments | |

Liabilities | Current Liabilities | Obligations due within one year | Accounts payable, short-term loans, accrued expenses, current portion of long-term debt |

Long-Term Liabilities | Obligations due after one year | Long-term debt, bonds payable, deferred tax liabilities, pension obligations | |

Equity | Owner's/Shareholders' Equity | The residual interest in assets after deducting liabilities | Common stock, preferred stock, additional paid-in capital, retained earnings, treasury stock |

Assets

Assets are listed according to their liquidity, which refers to how quickly an asset can be sold and turned into cash. This means that cash is ranked first, followed by receivables, then inventory, and eventually assets that aren’t liquid, which would include things

Liabilities

Following the same pattern. The current liabilities that require immediate payment are listed first, followed by the long-term debt.

Equity

Represents the portion left with the proprietors after payment of all liabilities. The retained earnings reveal the accumulated profits that the company has retained within it, meaning that the profits are not yet distributed to the proprietors in the form of dividends. This portion increases when the company makes profits and decreases when it declares dividends or makes losses.

Why is the Balance Sheet Important?

Liquidity Check: The current ratio (current assets ÷ current liabilities) tells you if a company can pay its bills in the next 12 months. A ratio below 1.0 signals potential cash problems.

Leverage Analysis: The debt equity ratio, or total liabilities divided by equity, measures a company’s dependence on debt. Such ratios indicate high levels of risk, though growth rates are potentially high too.

Investor Confidence: Banks require balance sheets before approving loans. Investors analyze them before buying stock. Private equity firms study them before acquisitions. No balance sheet means no deal.

Regulatory Compliance: Public companies must file balance sheets in their 10-K annual reports and 10-Q quarterly reports with the SEC. International companies follow similar requirements under IFRS. Missing or inaccurate balance sheets can trigger audits, fines, or delisting from stock exchanges.

How to Read a Balance Sheet

Standard structure and order:

Assets appear on the left (or top)

Liabilities and equity appear on the right (or bottom)

Each section moves from most liquid to least liquid (for assets) or most immediate to least immediate (for liabilities)

Quick reading checklist:

Check the date at the top—balance sheets are valid for one specific day only

Verify that total assets equal total liabilities plus equity

Look at current assets vs. current liabilities to assess short-term health

Compare this year's numbers to last year to spot trends

Calculate basic ratios: current ratio, debt-to-equity, return on equity

Interpretation tips:

High cash reserves usually signal financial stability

Large accounts receivable might indicate collection problems

Growing retained earnings show consistent profitability

Increasing liabilities aren't automatically bad, they might fund growth

Compare the company's ratios to industry averages for context

Red flags to watch:

Current liabilities exceeding current assets (liquidity crisis)

Negative shareholders' equity (the company owes more than it owns)

Sudden large changes in any line item without explanation

Declining cash with increasing receivables (revenue might not be real cash)

Real World Balance Sheet Example

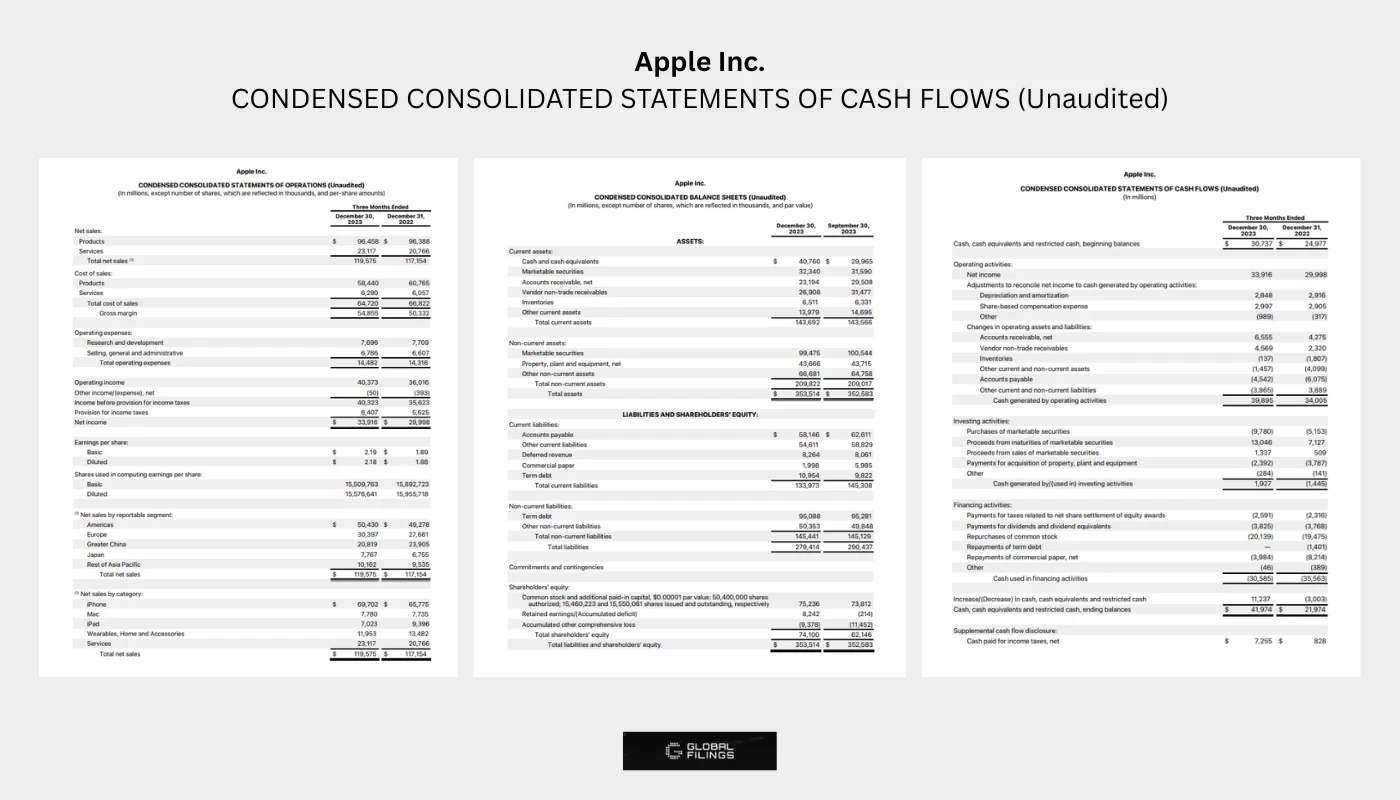

Apple Inc. offers a clear large scale example. In Q1 FY2024 ending December 30, 2023, Apple reported total assets of about $353 billion.

Apple held $162 billion in current assets, mainly cash, securities, and receivables. Non current assets reached $191 billion, driven by long term investments and property and equipment. This mix shows strong liquidity and long term focus.

Total liabilities stood at $290 billion. Current liabilities accounted for $112 billion. Long term obligations totaled $178 billion. Shareholders’ equity came in at $63 billion, built through retained earnings over time.

The numbers align cleanly. $353 billion in assets equals $290 billion in liabilities plus $63 billion in equity.

Use the same lens for your balance sheet. Check the date. Confirm the equation balances. Review whether assets and debt fit how your business operates.

Balance Sheet vs. Income Statement vs. Cash Flow Statement

Statement | What It Shows | Time Frame | Key Question Answered |

Balance Sheet | Financial position what you own and owe | Single point in time (e.g., December 31, 2024) | What is the company worth right now? |

Income Statement | Revenue, expenses, and profit or loss | Period of time (e.g., January 1–December 31, 2024) | Did the company make money this period? |

Cash Flow Statement | Actual cash coming in and going out | Period of time (e.g., January 1–December 31, 2024) | Does the company have enough cash to operate? |

All three statements connect. Net income from the P&L or Income Statement increases retained earnings on the balance sheet. Cash from the cash flow statement appears as an asset on the balance sheet. You need all three to understand a company's complete financial picture.

Related Reading: What is an Income Statement?

Limitations of a Balance Sheet

Static Nature: The balance sheet is accurate only on the date shown at the top. A company might have $1 million cash on December 31 but spend $800,000 on January 2. The balance sheet won't show that change.

Estimates and Assumptions: Depreciation, useful life of assets, and goodwill valuations all involve judgment calls. Two accountants might value the same asset differently.

Historical Cost Basis: Most assets appear at historical cost, rather than at current market value. A building purchased for $500,000, which could now be valued at $2 million, instead appears on the balance sheet at $500,000 (less accumulated depreciation).

Off-Balance-Sheet Items: Some of the liabilities such as operating leases or contingent liabilities may not be included in the balance sheet.

Bottom Line

At its core, this is your company's financial foundation. This is where you can see what you own, what you owe, and what belongs to your company's owners. In essence, this is done through an equation that you must learn how to read and understand properly.

Whether you are compiling a 10-K, acquiring a loan, or simply measuring your business performance, your balance sheet is not up for debate. Grasp the concept, and you'll be able to interpret your financial condition perfectly.

Frequently Asked Questions

What is the main purpose of a balance sheet?

A balance sheet shows a company’s financial position on a specific date. You see assets, liabilities, and equity in one place. This view helps you judge whether the business meets obligations.

How often should a company prepare a balance sheet?

Many businesses prepare balance sheets each month for internal review. External reports usually appear quarterly or annually. Public companies file quarterly 10 Q reports and annual 10 K reports.

What is the difference between current and non current assets?

Current assets turn into cash within one year, such as inventory. Non current assets support long term operations, such as buildings or patents.

Can a balance sheet show negative equity?

Yes. Negative equity appears when total liabilities exceed total assets. This situation signals financial stress and shows the business owes more than ownership value.

What does a balance sheet that does not balance mean?

A mismatch points to an accounting mistake. Common causes include missing entries, math errors, or incorrect data. The accounting equation always balances by definition.

Why do investors care about balance sheets?

Investors review balance sheets to judge financial strength. Debt levels show risk. Asset structure shows capacity to fund growth or pay dividends.

Is a strong balance sheet more important than profitability?

Each plays a role. A profitable company still fails after cash runs dry. A strong balance sheet supports survival during losses and funds recovery efforts.