An income statement explains how a business performed financially over a specific period. It shows how much money the company earned, how much it spent, and whether those activities resulted in a profit or loss.

This statement is one of the most widely used financial documents because it answers a simple and important question: Did the business make money during the period or not? Business owners, investors, lenders, and regulators all rely on the income statement to understand a company’s performance.

In this article, we’ll explore what an income statement is, how it works, its main components, common formats, how to calculate it step by step, and how it compares to the balance sheet and cash flow statement. By the end, you’ll clearly understand how to read an income statement and why it matters for evaluating a business.

What is an Income Statement?

An income statement is a core financial statement that shows a company’s revenues, expenses, and resulting profit or loss over a specific period. It explains how a business turns its sales into net income and helps determine whether the company operated at a profit or a loss.

An income statement is also known as:

Profit and Loss (P&L) statement

Statement of Earnings

Statement of Operations

Companies prepare income statements on a regular basis:

Monthly for internal review and cost control

Quarterly for performance tracking

Annually for investors, lenders, and regulatory filings

The income statement is used alongside the balance sheet and cash flow statement. Together, these three financial statements provide a complete view of a company’s financial performance and stability over time.

How an Income Statement Works

An income statement explains how a company’s revenue turns into profit or loss over a defined period. It starts with revenue generated from sales or services, then subtracts costs and operating expenses. As each category is subtracted, the statement moves step by step toward net income, which shows whether the company earned a profit or incurred a loss.

An income statement reports four main elements:

Revenue from business operations

Expenses incurred to earn that revenue

Gains from non-core activities

Losses from non-operating events

Income statements follow accrual accounting. This means:

Revenue is recorded when earned, even if cash is not yet received.

Expenses are recorded when incurred, even if payment happens later.

Because of this, profits shown in the income statement may differ from actual cash flow.

Main Components of an Income Statement

An income statement follows a clear structure that shows how a business earns money, what it spends, and what remains as profit. While the exact layout may differ by company or industry, the key components are largely the same across most income statements.

Revenue (Sales)

Revenue is the money a business earns from selling products or providing services during a specific period. It appears at the top of the income statement because every other figure is calculated from it.

It usually includes:

Operating revenue from core business activities

Adjustments for returns, discounts, or allowances

Revenue sits at the top because everything else in the statement flows from it.

Cost of Goods Sold (COGS)

COGS includes the direct costs of producing goods or delivering services. These are costs that increase or decrease with sales volume. Typical COGS item include:

Raw materials

Direct labor

Production-related costs

COGS does not include administrative or marketing expenses.

Gross Profit

Gross profit shows how much money remains after covering direct production costs.

Gross Profit = Revenue − Cost of Goods Sold

This figure helps evaluate:

Pricing strength

Production efficiency

Declining gross profit may indicate rising costs or pressure on pricing.

Operating Expenses

Operating expenses are the ongoing costs required to run the business on a day-to-day basis. It includes:

Salaries and wages

Rent and utilities

Marketing and advertising

Administrative expenses

These costs are often grouped as SG&A (Selling, General, and Administrative) expenses.

Operating Income (EBIT)

Operating income reflects profit generated from core business operations.

Operating Income = Gross Profit − Operating Expenses

This figure helps assess how well management controls costs within normal operations.

Non-Operating Items

Non-operating items come from activities outside normal business operations, such as interest income or expense, one-time gains or losses, and asset sales.

Earnings Before Tax (EBT)

Earnings Before Tax (EBT) shows a company’s profit before income taxes are deducted. It is calculated after subtracting operating costs and interest expenses from revenue.

Net Income (Profit or Loss)

Net income is the final profit or loss after all expenses, interest, and taxes from total revenue. It is often called the ‘bottom line’.

Net Income = Total Revenue − Total Expenses

Types of Income Statement

In practice, companies do not all present income statements the same way. The format they use often depends on how large the business is, how complex its operations are, and who will read the financial statements.

Under GAAP (Generally Accepted Accounting Principles), companies are allowed to prepare income statements using either a single-step or a multi-step format. Both formats follow the same accounting rules and both arrive at net income, but the difference lies in how much detail they provide along the way.

Single-step Income Statement

A single-step income statement uses one simple calculation. All revenues are grouped together, all expenses are grouped together, and the difference shows profit or loss. This format is often used by small or early-stage businesses because it is easy to prepare and easy to read. However, it does not show how production or operating costs affect profitability.

A single-step format works well when a business has:

One main source of revenue

Limited operating expenses

No need to analyze margins in detail

Multi-step Income Statement

A multi-step income statement presents profitability in stages. It first shows gross profit after deducting production costs, then operating income after operating expenses, and finally net income after interest and taxes. This structure makes it easier to evaluate how well the company’s core business is performing.

A multi-step format is better suited for businesses that need transparency. It helps to see:

How profitable core operations are

How efficiently the business is managed

How interest and taxes affect final earnings

This is why most public companies, and larger businesses use the multi-step format in their financial filings.

Single-step vs Multi-step Income Statement

Key Aspect | Single-step Income Statement | Multi-step Income Statement |

Typical Users | Small or simple businesses | Larger and public companies |

Core Focus | Final profit or loss | How profit is generated |

Cost Structure | All expenses combined | Costs split by function |

Operational Insight | Minimal | Clear view of core operations |

How to Calculate an Income Statement

To calculate income statement, follow the steps below:

1. Select the Reporting Period

Decide the time frame you want to analyze for your business, such as monthly, quarterly, or annually.

2. Calculate Total Revenue

Add up all income earned during the period. This includes revenue from core business activities and, if relevant, income from multiple products or services.

3. Determine Cost of Goods Sold (COGS)

Next, calculate the direct costs required to produce goods or deliver services like materials, direct labor, and production-related costs.

4. Compute Gross Profit

Subtract COGS from total revenue to find gross profit like below:

Gross Profit = Revenue − COGS

This figure shows how profitable the business is before considering operating and overhead expenses.

5. Add Up Operating Expenses

List all indirect costs needed to run the business, such as salaries, rent, utilities, marketing, and administrative expenses.

6. Calculate Operating Income

Subtract operating expenses from gross profit to find the operating income.

Operating Income = Gross Profit − Operating Expenses

7. Calculate Interest and Taxes

Then, deduce interest expenses on debt and income taxes.

8. Determine Net Income

The final figure is net income. Subtract interest and taxes from operating income.

Net Income = Operating Income − (Interest + Taxes)

Real-World Example of Income Statement

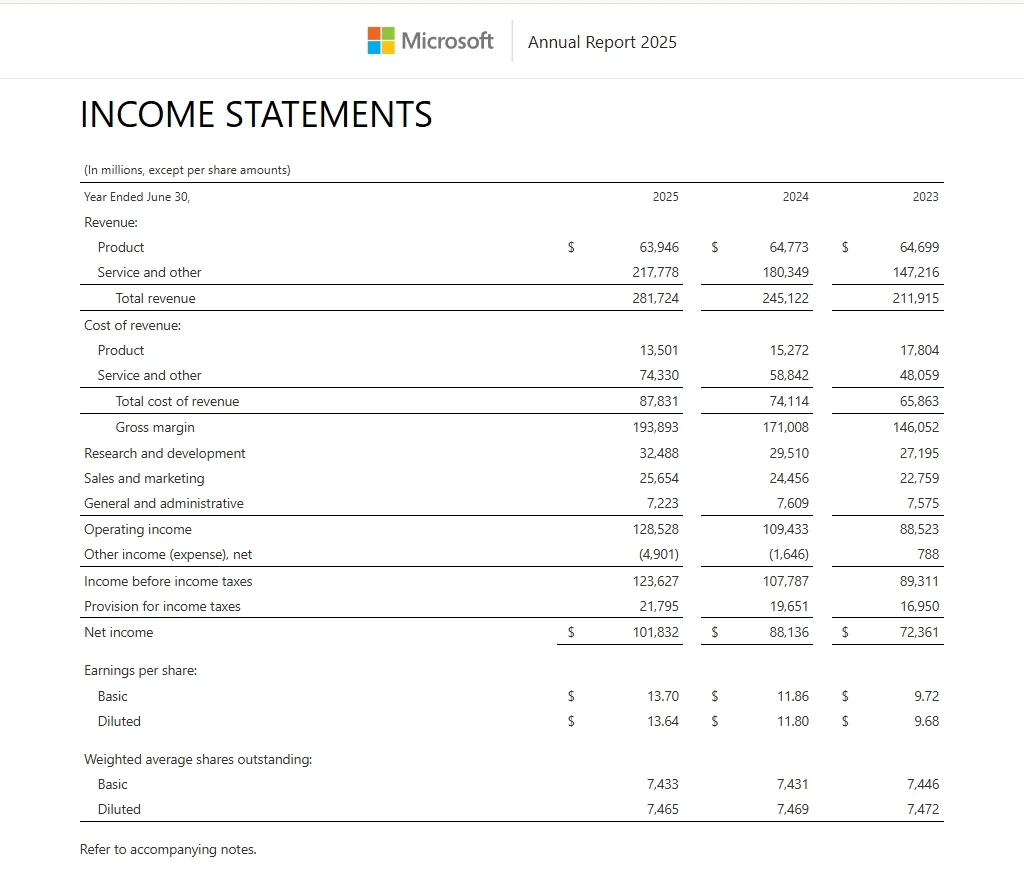

To see how an income statement works in real-world, let’s review the income statement of Microsoft’s annual report 2025.

During this period, Microsoft reported total revenue of $281.7 billion. The cost required to generate this revenue was $87.8 billion, leaving a gross profit of $193.9 billion. This means roughly 30% of revenue was spent on producing and delivering products and services, while the rest contributed to profit.

Microsoft then incurred operating expenses, including $32.5 billion in research and development, $25.7 billion in sales and marketing, and $7.2 billion in general and administrative costs. After subtracting these expenses, Microsoft reported operating income of $128.5 billion, which reflects earnings from its core business operations.

After accounting for interest and taxes, Microsoft recorded a net income of $88.1 billion. Based on 7.433 billion shares outstanding, this resulted in earnings per share (EPS) of $13.70, showing how much profit was earned for each share of stock.

Why Income Statements Matter

Income statements matter because they show how well a business is actually performing, not just what it owns. They explain whether a company is making money, losing money, or improving over time.

A balance sheet can show that a company owns many assets. But it cannot tell you if the company is actually making money. The income statement fills that gap.

It helps answer important business-related questions such as:

Is the business profitable?

Are costs increasing faster than revenue?

Is management controlling expenses effectively?

Is performance improving or declining over time?

For Business Owners and Management

Income statements provide a clear view of what drives profits and where costs can be controlled more effectively. This helps with budgeting, pricing decisions, and long-term planning.

For Investors

Income statements show earnings trends, operating efficiency, and growth potential which help investors decide whether a company is worth investing in.

For Lenders

Income statements help assess whether a company generates enough profit to meet loan and interest obligations.

Income Statement vs Balance Sheet vs Cash Flow Statement

Income Statement: Shows how the business performed over a specific period of time.

Balance Sheet: Shows the company’s financial position on a specific date.

Cash Flow Statement: Shows how cash actually moved in and out of the business over a time.

Differences at a Glance

What to Compare | Income Statement | Balance Sheet | Cash Flow Statement |

Purpose | It measures profitability | It shows financial position | It tracks cash movement |

Time Period | Covers a period (month, quarter, year) | Covers a specific date | Covers a period (month, quarter, year) |

Main Components | Revenue, expenses, net income | Assests, liabilities, equity | Operating, investing, financial cash flows |

What It Answers | Did the company make a profit or loss? | What does the company own and owe? | Does the company have enough cash? |

Bottom Line

To conclude, an income statement is the thing that provides a clear picture of your company’s financial performance over time. It shows how revenue is generated, how costs are managed, and whether the business ultimately earns a profit or incurs a loss. Once you know how to read it, you can quickly tell whether a business is growing, struggling, or improving over time.

If you regularly review financial data or company filings, tools like Global Filings can make this process much easier. Its AI-powered Corporate Filings helps you quickly access income statements, spot performance trends, and avoid spending hours digging through long documents. You can explore the platform and start a free trial to see how it simplifies financial analysis.

Frequently Asked Questions

What does an income statement show?

An income statement shows how much revenue a business earned, what expenses it incurred, and whether it made a profit or loss during a specific period.

What are the main components of an income statement?

The main components of an income statement include revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, earnings before tax (EBT), and net income.

Who uses income statements?

Business owners, management, investors, lenders, and regulators use income statements to evaluate financial performance.

How does an income statement differ from a balance sheet?

An income statement shows performance over time, while a balance sheet shows what a company owns and owes on a specific date.

Does an income statement show cash flow?

No, an income statement does not show cash flow. It records income and expenses when they are earned or incurred, not when cash is actually received or paid. Cash flow is shown in the cash flow statement.

What is the difference between gross profit and net income?

Gross profit shows how much money a company makes after direct costs of producing goods or delivering services, while net income shows final profit after all operating expenses, interest, and taxes.

Why do large companies use multi-step income statements?

Large companies use multi-step income statements because they provide more detail by separating operating and non-operating items, making performance easier to analyze.