You own shares in a company. That means you own a piece of that business. But do you actually know what's happening inside it? Most shareholders don't. They buy based on tips, trends, or gut feeling. Then they wonder why their investment tanked.

Financial statements are your window into the company. They tell you if management is doing a good job, if profits are real, and whether your shares are worth what you paid. Without reading them, you're flying blind. You wouldn't buy a house without an inspection. Why would you buy a company without one?

This blog explains which financial statements matter, what they reveal, and how to use them to protect your investment. We'll cover the three core documents every shareholder must review, how to spot red flags, and how to determine if your shares are actually valuable. No jargon. No fluff. Just what you need to know.

Which 3 Documents Must Shareholders Review?

Companies produce three main financial statements. Each one shows a different side of the business. Read all three. Relying on just one gives you an incomplete picture.

The Balance Sheet

The balance sheet reflects the assets and liabilities of the company at a point in time. Imagine this to be a picture that has been taken on the last day of the quarter.

Balance sheet = Assets = Liabilities + Equity

Assets refer to what the company owns (cash, inventory, property, equipment). Liabilities refer to what the company owes (loans, unpaid bills, debt). Equity represents what the shareholders own after the company pays all its liabilities.

Check the debt-to-equity ratio. If liabilities are much higher than equity, the company is heavily leveraged. That's risky. One bad quarter and it could collapse under debt payments.

Learn More: What is a Balance Sheet

The Income Statement

Accompanying it, the income statement reflects the profit and loss generated during certain periods, usually quarterly or annually. It's like a video of the performance of the company.

It starts with revenues, subtracts costs, and arrives at net income. It tells you if the company is making money or burning through it: revenue minus costs, both material and salaries, and rent, among others, will arrive at net income, or profit.

Watch the trend. Is revenue growing? Are expenses under control? A company can show profit one quarter and losses the next. Look at multiple periods to see the real pattern.

Learn More: What is an Income Statement?

The Cash Flow Statement

This is the most honest document. It tracks actual cash moving in and out of the business. Profit and cash are not the same thing. A company can show profit on paper but have no cash in the bank.

The cash flow statement breaks down into three parts: operating activities (cash from actual business), investing activities (buying/selling assets), and financing activities (loans, dividends).

Free cash flow is what matters most. It's the cash left after the company pays for everything it needs to operate. If free cash flow is negative for too long, the company is in trouble. No matter what the income statement says.

Important: Always read the "Notes to Financial Statements." That's where companies disclose risks, accounting methods, and details they're required to mention but don't want to highlight. Lawsuits, pending regulatory issues, and unusual accounting treatments often hide there. To deep drive, read What is a Cash Flow Statement?

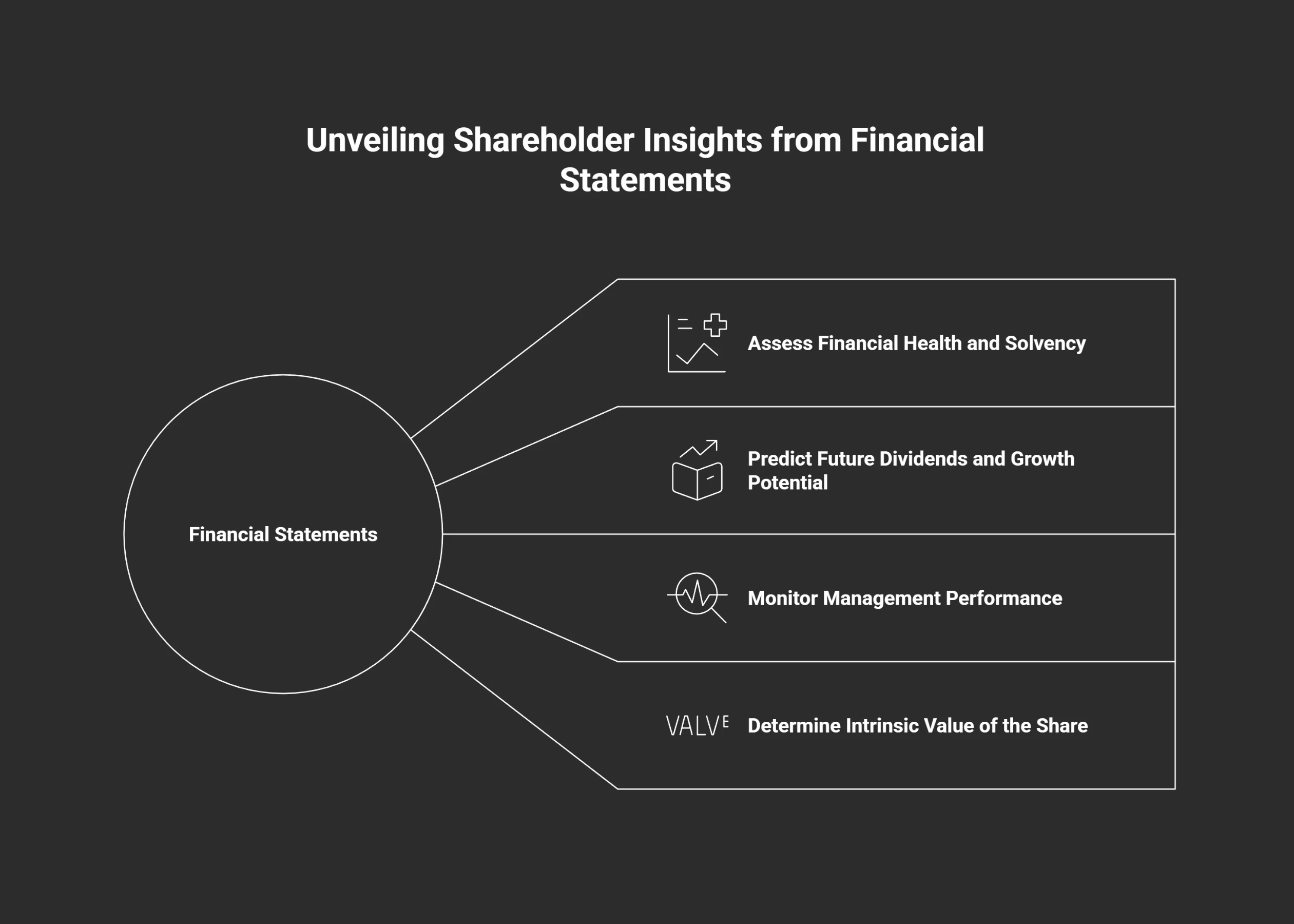

How Shareholders Use Financial Statements

Shareholders use these documents to make informed decisions. Here's what the statements help you do:

Assess financial health and solvency – Can the company pay its bills and survive tough times?

Predict future dividends and growth potential – Will you get paid? Will the business expand?

Monitor management performance – Are executives doing their job or wasting resources?

Determine the intrinsic value of the share – Is the stock price justified by actual performance?

Let's break down each one.

To Assess Financial Health and Solvency (Can They Survive?)

Before you even think about whether the company is currently paying dividends or growing, you should consider this question first: will this company be around in five years?

Shareholders come last when a company goes belly up. Creditors, then employees, and then bondholders get paid before shareholders. So, if there's nothing left for shareholders, their stocks will be worthless. That's why financial health checks are not optional.

You need to evaluate two things: liquidity and solvency.

Metric | What It Measures | How to Calculate | Safe Range |

Liquidity | Can the company pay bills due now? | Current Ratio = Current Assets ÷ Current Liabilities | Above 1.5 |

Solvency | Can the company survive long-term debt? | Debt-to-Equity = Total Debt ÷ Total Equity | Below 1.0 (varies by industry) |

Liquidity answers whether the company can cover immediate obligations. A current ratio below 1.0 means it owes more in the short term than it can quickly access. That's danger.

Solvency looks at long-term survival. High debt relative to equity means the company is over-leveraged. One downturn and it could collapse under debt payments.

Check both. A company can be liquid today but insolvent tomorrow if debt is crushing it.

To Predict Future Dividends and Growth Potential

Dividends are a result of profit, but dividends are distributed in cash. That is a very big difference. A firm can report a high net income yet have no cash to distribute, which can be tied up in inventory, accounts receivable views, or investments.

It will be seen that the income statement reveals the net income. This is a beginning point. Then look at the cash flow statement afterwards. Examine the free cash flow in the cash flow statement. If the figure increases and is positive at the end of the process, then the firm has the ability to pay dividends and expand at the same time.

Retained Earnings: On the balance sheet, retained earnings reveal how much of the profit the business has retained, rather than distributing it. An increase in retained earnings indicates investments in the future, while a decrease could imply the business may be struggling or paying out more cash than it is taking in.

Bottom line: profit doesn't equal cash. If free cash flow is weak, don't expect reliable dividends no matter what the income statement promises.

To Monitor Management Performance (Stewardship)

Shareholders own the company. Management runs it. That separation creates a problem. Managers might act in their own interest instead of yours.

Financial statements reveal how well management is doing its job. Here's what to watch:

Return on Equity (ROE) – This shows how much profit management generates with shareholder money. Formula: Net Income ÷ Shareholder Equity. Higher ROE means efficient management.

Rising expenses without rising revenue – If costs are climbing but sales aren't, management is wasteful or ineffective.

Executive compensation vs. performance – Check the notes or proxy statements. Are executives getting raises while profits fall? That's a red flag.

"Other expenses" category ballooning – Vague line items often hide poor decisions or questionable spending.

Use this information when voting on management compensation or board elections. If the numbers look bad, vote accordingly. You have that right as a shareholder.

To Determine the Intrinsic Value of the Share

Share price is what you pay. Value is what you get. They're not always the same.

Financial statements give you the data to calculate a stock's intrinsic value. Two key metrics come directly from these documents:

Earnings Per Share (EPS) – Net Income ÷ Total Shares Outstanding. This tells you how much profit the company makes per share. Higher EPS is better.

Price-to-Earnings Ratio (P/E) – Share Price ÷ EPS. This compares the stock price to actual earnings. A high P/E means investors are paying a lot for each dollar of profit. That could mean the stock is overvalued or that investors expect strong future growth.

Compare the P/E ratio to competitors in the same industry. If a company's P/E is much higher than similar businesses, ask why. Is it genuinely better, or is the stock just expensive?

Book value per share (Total Equity ÷ Shares Outstanding) shows what each share is theoretically worth based on assets minus liabilities. If the share price is far above book value, you're paying a premium. Make sure the company's performance justifies it.

Financial statements won't tell you the exact "right" price. But they give you the raw numbers to decide if a stock is cheap or expensive relative to what the company actually does.

Bottom Line

Financial statements aren’t optional homework, by the way. They’re your protection as a shareholder. They reveal whether management is capable, whether earnings are valid, and whether your investment is sound.

Understand all three basic statements, which include the balance sheet, explaining what is owed and what is owned, the income statement, which illustrates profit and loss, and the cash flow statement, which reflects actual cash flows.

Use these documents to monitor management’s performance, forecast dividends, and determine what your stock is really worth. Deal in facts, not hopes. That is how your wallet will be protected from costly errors.

Read Our Related Recourses:

Frequently Asked Questions

Can a company fake financial statements?

Yes, but it's illegal. Auditors review statements to reduce fraud risk, but scandals like Enron prove it's possible. Always check the auditor's report and read the notes carefully.

How often are financial statements released?

Public companies release quarterly reports (10-Q) and annual reports (10-K). Private companies may only report annually.

What's the difference between profit and cash flow?

Profit is accounting income. Cash flow is actual money moving in and out. A company can be profitable on paper but broke in reality if cash flow is negative.

What is a good debt-to-equity ratio?

It varies by industry. Generally, below 1.0 is safer. Above 2.0 means high leverage and higher risk. Compare companies within the same sector.

Do I need to be an accountant to read financial statements?

No. You need to understand the basics: revenue, expenses, assets, liabilities, and cash flow. Most critical information is visible without advanced accounting knowledge.

Where can I find a company's financial statements?

Public companies file with the SEC. Visit sec.gov and search the company name. Look for 10-K (annual) and 10-Q (quarterly) reports. Company investor relations websites also post them.