A cash flow statement is a type of financial statement that shows the total flow of cash in a business for a given period. This period can be a month, a year, or a quarter. This statement highlights sources from which cash flow, their uses, and whether sufficient cash is left for smooth business performance.

This statement addresses an important but simple answer: Does the company/business have available cash to operate when it needs it? Business owners, investors, and lenders depend on it to understand liquidity, stability, and the company’s ability to meet daily expenses.

In this following guide, we’ll introduce what is cash flow statement, how it functions, key elements of it, and how it is different from balance sheets and income statements. You’ll also see a real-world example and learn why cash flow statements matter when evaluating a business.

What Cash Flow Statements Tell You

Cash flow statements reveal the effectiveness of the company in managing its cash. It does not concern itself with the profit made. What it is concerned about is real money.

These are statements that help you understand if a business has sufficient funds to operate. A company could appear to be making profits, but if it isn’t receiving funds on time, it still has difficulties.

In simple terms, cash flow statements help create a clear picture of whether the company is actually generating cash, spending it well, or keeping enough cash on hand to stay stable.

Following are some key insights it provides:

Cash generation or consumption through operations: You can see if the core business is generating cash or consuming it. If operations cannot produce cash, problems usually arise.

Liquidity position: It indicates how liquid a company is; that is, it highlights how much cash it has and whether it has enough cash to pay its short-term financial requirements.

Cash movement: It tracks real money coming in from customers and going out to suppliers, employees, and other expenses. Many businesses fail not because they lack profit, but because they run out of cash.

Long-term financial stability: It highlights debt dependence and whether the business can sustain itself over time.

Decision-making clarity: Managers, investors, and lenders use this information to judge stability, growth, and risk.

How Does a Cash Flow Statement Work?

A cash flow statement works in a simple structure. It doesn't care about invoices or accounting entries. It only tracks the money that actually comes in and goes out.

A cash flow statement generally reports three key areas:

Cash generated or used by core business operations

Cash spent on or received from long-term investments

Cash raised from or returned to lenders and shareholders

Unlike the income statement, the cash flow statement focuses only on real cash that means:

Cash is recorded only when money is actually received or paid

Non-cash items like depreciation or credit sales are excluded

Main Components of a Cash Flow Statement

A cash flow statement has three main components: Operating activities, Investing activities, and Financial activities.

In this section, you’ll see how each component shows a different type of cash activity.

Operating Activities

The operating activities show how the company is generating cash from its regular business operations. This includes cash received from customers and cash paid for everyday expenses like salaries, rent, suppliers, and taxes.

In simple terms, this section tells you whether the business generates cash from what it actually does. If operating cash flow stays negative for long, it may affect the business, even if profits look fine.

Investing Activities

Investing activities focus on long-term decisions made by the business. This includes cash spent on buying equipment, property, or technology, as well as cash received from selling assets.

Often, this part of the cash flow statement shows cash going out rather than coming in. That is usually normal, especially for growing companies, because investment today is meant to support future growth.

Financial Activities

Financing activities explain how the business raises money and pays it back. This section includes cash from loans, loan repayments, issuing shares, paying dividends, or buying back stock.

Through this, you can see whether a company depends more on debt, equity, or internal cash. It also shows how the business manages its obligations to lenders and shareholders.

Methods for Calculating Cash Flow Statement: Direct & Indirect

There are two methods to calculate a cash flow statement: Direct method and Indirect method. The key difference between these two methods is how operating cash flow is presented.

Direct Method

A direct method shows how cash moves through daily business operations. Under this method, operating cash flow is shown using actual cash transactions. It lists cash collected from customers and cash paid for operating expenses such as suppliers, salaries, rent, and taxes.

Indirect Method

Like the direct method, an indirect method also reports operating cash flow, but it starts with net income instead of listing cash receipts and payments. It is used because it connects the income statement and balance sheet to the cash flow statement and is easier to prepare.

Non-cash expenses like depreciation are added back, and changes in working capital are adjusted to convert accounting profit into actual cash flow from operations.

Understanding Positive vs. Negative Cash Flow

Positive cash flow means your business is receiving more cash than it is spending.

Negative cash flow is the reverse. It means your business is spending more than receiving.

Positive cash flow is generally better. But negative cash flow does not always mean poor performance. It may happen if expenses are high or customers pay late. But if it continues for a long time, then it can create serious financial pressure.

Cash Flow Statement vs Balance Sheet vs Income Statement

Check out how cash flow statement differs from balance sheet and income statement:

Aspects | Cash Flow Statement | Balance Sheet | Income Statement |

Main focus | Tracks actual cash coming in and going out | Shows what the company owns and owes | Shows profit or loss from business activity |

Time period | Covers a period (month, quarter, year) | Snapshot on a specific date | Covers a period (month, quarter, year) |

Question it answers | Does the company have enough cash to oeprate? | What does the company own and owe right now? | Did the company make money? |

A Real Example of Cash Flow Statement

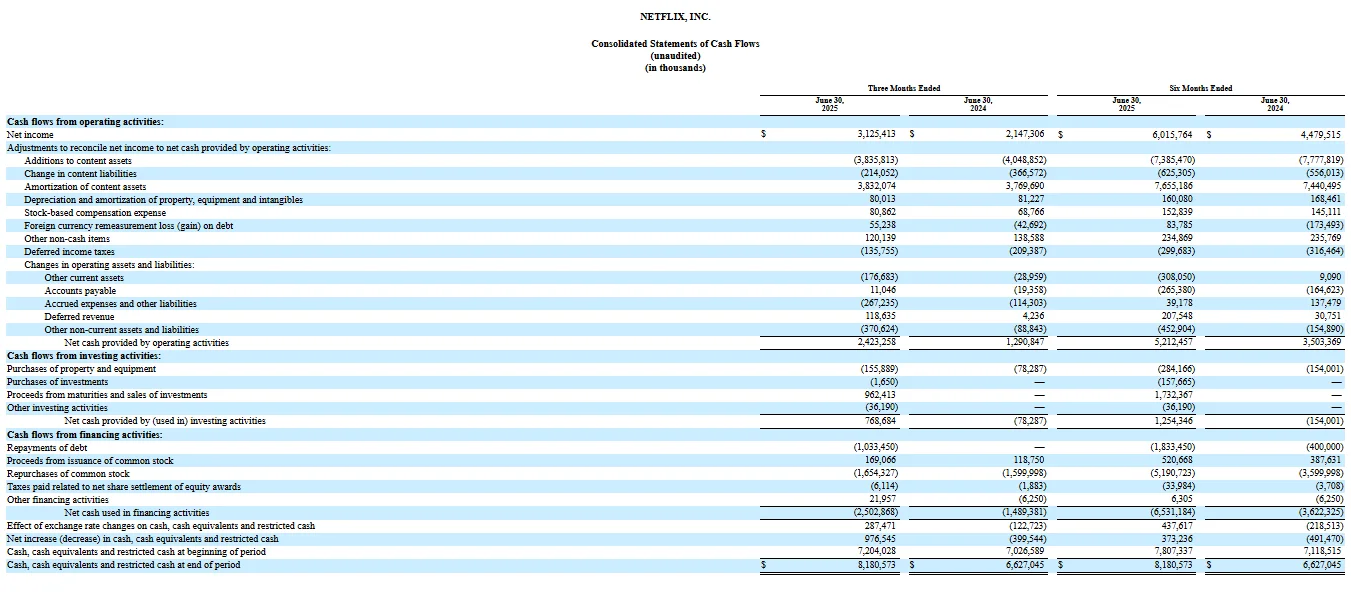

If you want a real-world example, let’s look at Netflix’s cash flow statement from its latest annual report.

Why Cash Flow Statements Matter

Cash flow statements matter because they show what is really happening to a company’s money. From the outside, a business may look successful because it reports strong profits. But that is not always the full story.

A company can still struggle or even fail if the cash is not coming at the right time. And this is where cash flow statements become critical.

Income statements and balance sheets do not clearly show real cash movement. The cash flow statement fills this gap by:

Revealing if a company can actually survive, pay its bills and fund future growth.

Comparing the operating cash flow with net income to judge the quality of earnings.

In practice, a cash flow statement typically answers the following questions:

Can the company pay salaries, rent, and other short-term expenses on time?

Is the business generating enough cash from its core operations?

How much does the company rely on debt or external funding?

Are reported profits turning into actual cash?

Limitations of Cash Flow Statement

It does not show if a business is profitable.

One-time cash events like asset sales or loans can mislead results.

Timing of cash receipts and payments can distort results.

Bottom Line

To sum up, a cash flow statement is the document that provides a clear understanding of how cash is coming in and out of a business. It shows if a company can pay its bills, sustain daily operations, and support its growth in future. Once you understand it, you can judge the real financial strength of a company beyond reported profits.

If you regularly review financial filings or compare companies, tools like Global Filings can make this process much easier. Its AI-powered Corporate Filings helps you quickly access cash flow statements, understand cash movements across periods, and spot liquidity trends without digging through lengthy documents. Explore the platform and start a free trial to see how it simplifies cash flow analysis and financial research.

Frequently Asked Questions

What are the three main parts of a cash flow statement?

The three main parts of a cash flow statement are operating activities, investing activities, and financing activities. Each of the parts shows a different source or use of cash.

Who uses cash flow statements?

Business owners, investors, lenders, and analysts use cash flow statements to assess liquidity, stability, and financial risk.

How often is a cash flow statement prepared?

Most companies prepare cash flow statements monthly, quarterly, and annually, depending on reporting and regulatory requirements.

Why is the cash flow statement important if a company is profitable?

The cash flow statement is important because even if a company is profitable, it can still face problems if customers delay payments or expenses need to be paid earlier.

What is the difference between direct and indirect cash flow methods?

The direct method lists actual cash received and paid in operations, whereas the indirect method starts with net income and adjusts for non-cash items and working capital changes.

Can a company have a negative cash flow and still be healthy?

Yes. Because negative cash flow can happen when customers pay late or expenses are high. But long-term negative cash flow can create financial risk.